Understanding Exness Credit Card Withdrawal Process

The process of exness credit card withdrawal Exness mobile app is designed to be straightforward and efficient, allowing traders to access their profits with ease. However, like any financial operation, it is crucial to understand the steps, potential pitfalls, and best practices to ensure a smooth transaction. This guide will delve into every aspect of withdrawing funds through Exness using a credit card, covering everything from eligibility to fees, and providing tips for a seamless experience.

What is Exness?

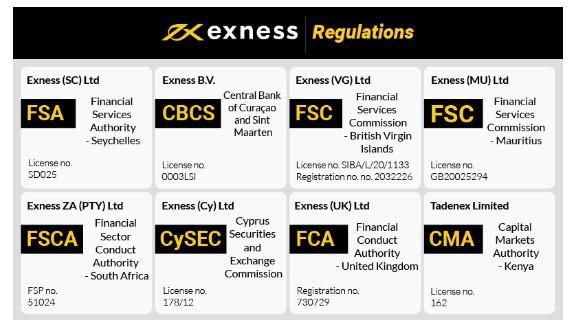

Exness is a well-known online forex broker that offers a wide range of financial instruments, including forex, commodities, cryptocurrencies, and indices. Established in 2008, the company has grown rapidly and gained a reputation for its user-friendly platform, competitive spreads, and diverse account types. Exness is regulated by several financial authorities, which adds a layer of assurance for traders.

Introduction to Credit Card Withdrawals

Withdrawing funds from your trading account to a credit card is a popular method for many traders, thanks to its convenience and speed. Credit card withdrawals typically allow for quicker processing times compared to other methods, making it an ideal choice for those who prefer to access their funds promptly.

Is Credit Card Withdrawal Available for All Users?

Before diving into the withdrawal process, it is essential to check whether your credit card withdrawal options are available. Generally, Exness allows withdrawals to credit cards that have been used for deposits. Therefore, if you initially funded your trading account using a credit card, you can subsequently withdraw your funds back to that card.

However, it’s crucial to note that not all countries support credit card withdrawals with Exness. Always verify with the Exness website or customer support for your specific region’s regulations.

Step-by-Step Guide to Withdrawing Funds via Credit Card

Here’s a simple guide to help you through the Exness credit card withdrawal process:

1. Log into Your Exness Account

Start by logging into your Exness account. Make sure you have verified your account, as this will be a requirement for withdrawals.

2. Navigate to the Withdrawal Section

After logging in, go to the “Withdrawal” section located within the account management panel. This section will provide you a list of available withdrawal methods.

3. Select Credit Card as Your Withdrawal Method

Choose the credit card option from the withdrawal methods presented. Ensure you select the correct card that you previously used for deposits.

4. Enter the Withdrawal Amount

Input the amount you wish to withdraw. This can be any amount, as long as it adheres to Exness’s minimum and maximum withdrawal limits.

5. Confirm the Transaction

After entering the amount, review all the details carefully. Once confirmed, the funds will be processed and sent to your credit card.

Timing of Credit Card Withdrawals

The timing for credit card withdrawals can vary based on financial institutions. While Exness processes the withdrawal requests instantly, your bank may take an additional 3 to 5 business days to post the funds to your account. It’s wise to consider this timeframe when planning your withdrawals.

Fees Associated with Credit Card Withdrawals

Exness generally does not charge fees for credit card withdrawals; however, your bank may impose its fees. Always check with your bank regarding any charges that may apply to credit card transactions.

Common Issues and Troubleshooting

While the withdrawal process is typically straightforward, issues can sometimes arise. Here are a few common problems and their solutions:

1. Withdrawal Request Not Processed

If your withdrawal is delayed, first check your email for notifications from Exness regarding any issues. If there are none, contact their support for assistance.

2. Bank Declined the Transaction

Sometimes banks might block transactions due to security protocols. If this happens, contact your bank to resolve the issue.

3. Incorrect Details Entered

Double-check that you have entered the correct credit card details and withdrawal amount. Any errors might lead to delays in processing.

Best Practices for Credit Card Withdrawals

To ensure a smoother withdrawal experience, consider following these best practices:

- Always use the same credit card for withdrawals that you used for deposits.

- Make sure your account is fully verified before initiating a withdrawal.

- Keep track of any fees your bank might charge and plan your withdrawals accordingly.

- Maintain an active communication line with Exness support for quick assistance if needed.

Conclusion

Withdrawing funds via the Exness credit card withdrawal method is a convenient option for many traders. By understanding the process, eligibility, timing, and any associated fees, you can navigate your withdrawals confidently and efficiently. Remember to check for all requirements and keep track of your transactions to avoid complications. For those considering trading with Exness, the overall experience is enhanced by the reliability of their withdrawal methods – making trading not just an opportunity, but a manageable one.